Take Control of Your Credit Score

Discover the Secrets to Boosting Your Credit Score Through DIY Repair Methods

https://storage.googleapis.com/msgsndr/R7KP4s9vl29I2U887gy1/media/640d47491ac034debc4048ce.jpeg

Take Control of Your Credit Score

Discover the Secrets to Boosting Your Credit Score Through DIY Repair Methods

https://storage.googleapis.com/msgsndr/R7KP4s9vl29I2U887gy1/media/640d47491ac034debc4048ce.jpeg

How It Works

Our 3 Step Process

Step 1

Connect Your Credit Report

Connecting your credit report to our system enables us to generate customized letters tailored to your specific credit situation, maximizing their impact on removing negative items and improving your creditworthiness.

Furthermore, integrating your credit report allows us to closely monitor your progress throughout the credit repair process, ensuring that the next rounds of letters target the right areas, keeping you informed and empowering you on your journey to better credit.

Step 2

Choose Accounts To Dispute

Selecting the accounts for dispute is a crucial step in the credit repair process. By connecting your credit report, our system can effectively track and address the negative items with each round of dispute letters.

Our experts will guide you in identifying the accounts that require attention, ensuring a focused approach to improving your credit. With a comprehensive understanding of your credit profile, we strategically work towards disputing inaccuracies and paving the way for a better financial future.

Step 3

Generate Dispute Letters

Once you've selected the accounts for dispute, our system enables you to pick the appropriate letter templates for each negative item on your credit report. Simply select the letters, preview them for accuracy, and print and mail them to the credit bureaus and creditors.

By taking this step, you actively participate in the credit repair process, ensuring that the necessary documentation is sent to the right entities, increasing the chances of successful disputes and the removal of negative items from your credit report.

How It Works

Our 3 Step Process

Step 1

Connect Your Credit Report

Connecting your credit report to our system enables us to generate customized letters tailored to your specific credit situation, maximizing their impact on removing negative items and improving your creditworthiness.

Furthermore, integrating your credit report allows us to closely monitor your progress throughout the credit repair process, ensuring that the next rounds of letters target the right areas, keeping you informed and empowering you on your journey to better credit.

Step 2

Choose Accounts To Dispute

Selecting the accounts for dispute is a crucial step in the credit repair process. By connecting your credit report, our system can effectively track and address the negative items with each round of dispute letters.

Our experts will guide you in identifying the accounts that require attention, ensuring a focused approach to improving your credit. With a comprehensive understanding of your credit profile, we strategically work towards disputing inaccuracies and paving the way for a better financial future.

Step 3

Generate Dispute Letters

Once you've selected the accounts for dispute, our system enables you to pick the appropriate letter templates for each negative item on your credit report. Simply select the letters, preview them for accuracy, and print and mail them to the credit bureaus and creditors.

By taking this step, you actively participate in the credit repair process, ensuring that the necessary documentation is sent to the right entities, increasing the chances of successful disputes and the removal of negative items from your credit report.

Here Is What You Get

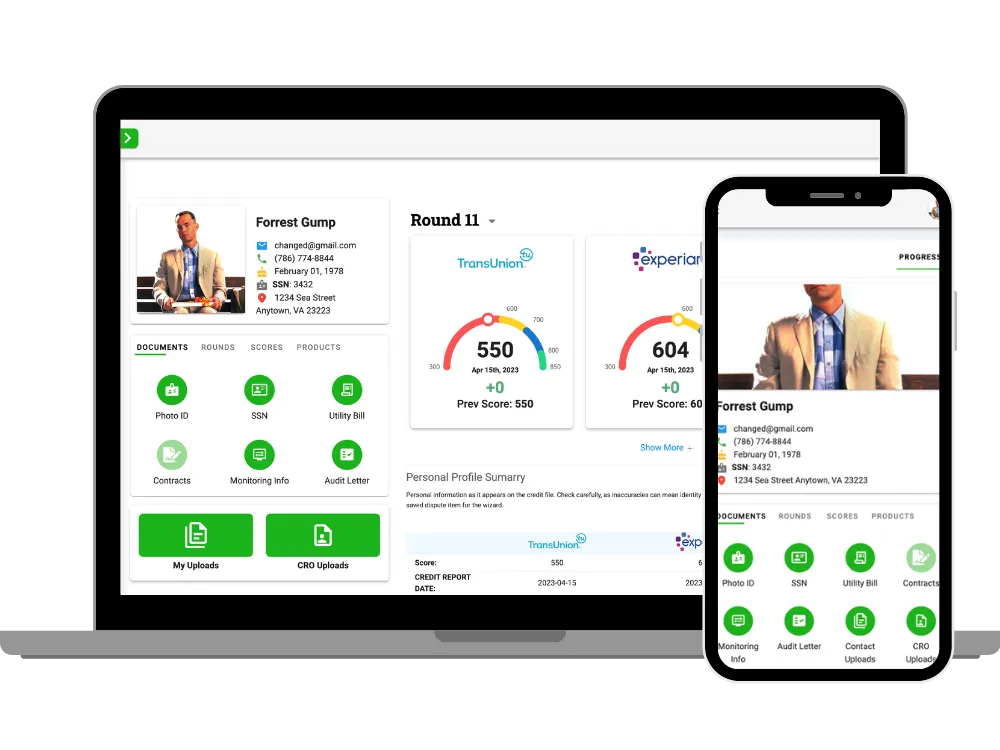

Credit Repair Software

Access to the best most intuitive Credit Repair Software in the market.

DIY Credit Repair Course

This is a complete A to Z DIY Credit Repair Course that is exactly how we do it if you hire us.

Contact Us

About Us

The Short

The Long

Contact Us

All Rights Reserved X BUSINESS SOLUTIONS 2024